Banking and the Federal Reserve

Printable Version

A bank is an important financial institution in the modern world. Many nations throughout the world have a central bank. These institutions act as financial agents for the governments that sponsor them, holding national funds, ensuring and regulating the value of their currency, and regulating their banks. The concept of a central bank is an old one. The United States chartered its first central bank in 1791. The Federal Reserve is the current central banking system of the United States of America. In 1913 Congress passed the Federal Reserve Act, which established the Federal Reserve. One of the most influential proponents of this act was Robert L. Owen, a senator from the young state of Oklahoma. Today, the Federal Reserve has a complex, but important, mission:

- To promote financial stability and sustainable economic growth

- To foster the integrity, efficiency, and accessibility of payments and settlement systems

- To promote the safety and soundness of the nation's banks

In this section you can learn about the history of banks in the United States, how the Federal Reserve operates, the important figures of the Federal Reserve Act and American banking in the past, and also the basic concepts of the banking industry. Be sure to check out the activities, games, and coloring sheets when you are done!

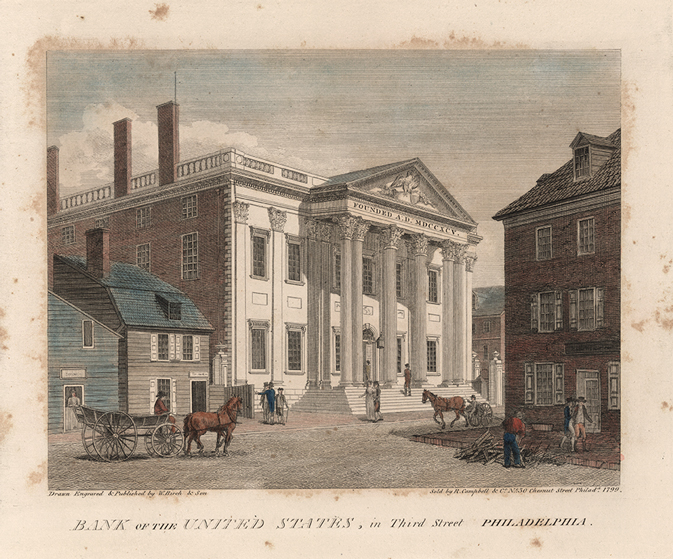

The First Bank of the United States, located on South Third Street in Philadelphia, Pennsylvania, built from 1795 to 1797 (image courtesy of the Rare Book and Special Collections Division, Library of Congress).