Commerce in Oklahoma

Activities

Investigating Local History

Banks and Oklahoma Communities

As Oklahoma grew in population, communities organized. These new population centers attracted businesses to sell goods and services. Banks within these communities helped the economy grow by allowing residents to pool their resources and loan money to individuals wanting to start or expand a business.

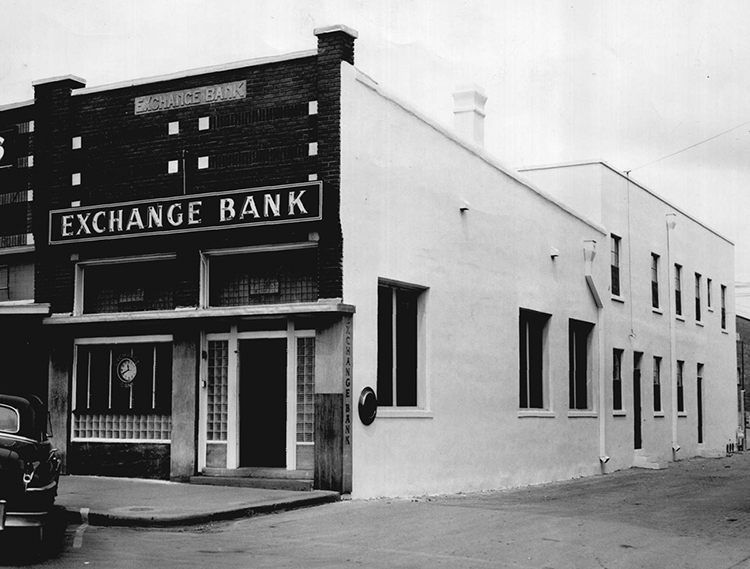

In 1896, Fred G. Moore established Exchange Bank in Perry. He, along with his brother-in-law, invested $5,000 to operate the bank. Perry residents clearly needed a bank. The community deposited $1,000 into the bank on its first day of operation. Local residents sought loans for many reasons, but they usually centered on purchasing property and expanding farm operations. In 1909, O. R. Hall became an assistant cashier at the bank. Fred G. Moore and O. R. Hall continued to work at Exchange Bank for the rest of their lives, as did the younger generations in both families into the 21st century.

A loan is the primary way a bank makes money. Once a bank approves an individual for a loan, the bank gives the person the amount of money they agreed upon. The bank then charges the person the cost of their original loan plus an additional amount. This additional charge is called interest. The individual who takes the loan out pays interest so they can borrow money they otherwise could not get. The bank owners take the interest and will save it, use it to invest, or use it to pay for expenses like employee salaries and rent for the building.

Bank employees must be careful, accurate, and use good judgment. If they grant a large number of loans that are not paid back, they run the risk of a bank failure. A bank failure is when a bank is unable to pay its depositors. Because most communities had one bank and everyone deposited their money in that bank, a bank failure could be disastrous for an entire community. In order for the community to stay healthy and grow, the bankers had to be cautious enough to protect their depositors but risk enough to earn interest.

What bank is located nearest to where you live?

Can you visit their website and find out their history?

The “new” Exchange Bank in Perry, 1950 (2012.201.B1017.0391, OPUBCO Collection, OHS).

Computation: Life as a Bank Teller

Fred G. Moore, O. R. Hall, and all the other employees at Exchange Bank spent their days finding the answers to questions similar to the ones below. How many questions can you answer?

One of the basic responsibilities of a bank teller is to take people’s money and add it to their account. This is called a deposit. When a person take money from their account, it is called a withdrawal. Managing deposits and withdrawals requires strong cash-handling and arithmetic skills. See if you have what it takes to be a cashier.

Mr. Marks comes in and hands you a one-hundred-dollar bill. He says he would like $75 deposited into his savings account and the rest in cash. How much cash do you give him?

Taylor visits the bank to deposit the day’s sales. There are four checks in the amount of $15.05, $210.25, $34.00, and $26.75, and $115.30 in cash. Taylor says they want two rolls of quarters (each roll is $10) and the rest of the money deposited in the business account. How much does Taylor deposit?

John comes in after he accidentally overdrew on his account. An overdraft is when an account owner authorizes the payment of more money than the account has. Usually, the bank will cover the overdraft, but they will charge a fee to do so. John overdrew his account by $10.45 and the fee is $30. John deposits $150 into his account. What is his account balance after paying back the amount the bank covered and the fee?

Oklahoma bank tellers assist customers in 1948 (21412.M191.7, Z. P. Meyers/Barney Hillerman Photographic Collection, OHS).

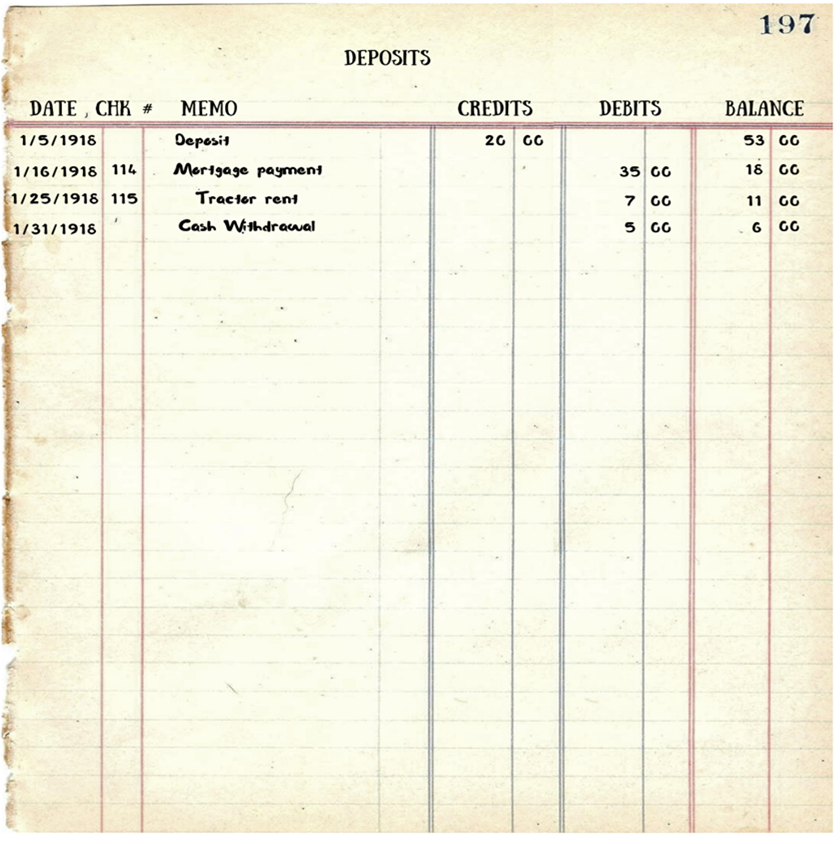

Computation: Balancing Books

Another responsibility bank employees have is to keep a ledger. A ledger lists what is put in and taken out of an account. Today, this is electronic and mostly done automatically. When the Exchange Bank began, the employees kept a record of every depositor’s account activity in a book called a Boston ledger. Here is a ledger to practice your teller skills:

You will notice that if it is money going into the account, then it is entered in the “credits” column. That amount is added to the balance amount of the previous line, and the new balance is entered in the far right column titled “balance.” If money is coming out of the account, either through a check or a cash withdrawal, it is listed under “debits” and subtracted from the balance on the line above. The new balance is entered on the far right column.

Try it yourself:

The farmer worked on a railroad maintenance crew over the winter. He returns in January with $72 and then deposits $70 when he comes into town on February 3, 1918. The farmer’s wife sells eggs and butter. She deposited $10 in the bank on February 15, 1918. The mortgage payment is due every month on the 15th. They pay the same amount every month, and this payment is on check number 116. The farmer does not need to rent a tractor in February, but he needs to buy seed for the upcoming growing season. The seed costs $38.75 on March 15, and the farmer pays with check number 117. What is the family’s balance on March 16?

Using Formulas: Simple and Compound Interest

Another common responsibility for bank officers is computing interest. If the bank grants a loan, they need to compute the interest to ensure the borrower knows how much to pay each month. During the early 1900s, the type of interest charged was called simple interest. If the bank loaned at an 8 percent rate, then the borrower paid the total amount of the loan plus another 8 percent of the loan in interest. To determine simple interest, you can use this formula:

A = P(1+rt)

A—is the final total loan amount

P—the original amount loaned

r—the annual interest rate

t—time (in years)

Try to compute simple interest:

Jose borrows $3,000 at five percent interest for five years. What is the total amount Jose will pay for the loan?

Here’s a twist: Mr. Jordan pays a total of $15,600 for a loan he took out for 10 years at three percent interest. What was the principal amount of the loan?

If a customer opens a savings account, the account earns interest. Banks want customers to deposit money into accounts and leave it for some time so that the bank can use the money for loans. Instead of earning simple interest, savings accounts usually earn compound interest. Compound interest means that interest is earned on whatever is deposited at the start of the account AND the interest it has earned previously. The bank will add the interest to the principal every month, quarter, or year and then use that as the new total to earn interest. This can really add up!

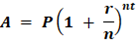

The formula for compound interest is a little different than simple interest. It is:

A—Account total

P—Original deposit

r—Interest rate

n—Number of times interest applied per time period

t—Number of time periods

Try to find the answer to this question about compound interest:

Deisy opens a savings account and deposits $100. The account earns .20 percent interest, compounded monthly. How much will Deisy have if she never adds more to the account and keeps the account for five years?

Evaluating: Balancing Risk and Opportunity

Another responsibility of bank officers is making wise use of the money the community has invested with them. When they review a loan application, they will give a lower interest rate if they believe the applicant will pay back the whole loan on time. If they believe there is a chance of default, which means not paying back the entire loan, they may deny the application or charge a higher interest rate because they think it is a riskier investment.

The loan application will include a lot of information, but the most important sections show how much the applicant makes, what the applicant may owe on other debts, and what they own that the bank can foreclose on or take in case of default. The property and investments an applicant has are called assets. Debts and other obligations on a person’s income are called liabilities. The list of these for an applicant is called a balance sheet. A loan officer will look at the balance sheet to determine if they should grant the loan and at what interest rate.

Pretend you are a loan officer and need to determine if you will grant a loan. If you grant the loan, you can pick an interest rate of 10 or 20 percent, depending on how risky you think the loan might be. Remember, you make money by loaning money, so you need to keep your interest rates low enough that people will still come to your bank. At the same time, you need to have high enough interest rates that you are covered on all your investments and don’t run the risk of a bank failure.

Ricky’s Balance Sheet

Ricky wants to open a frozen yogurt shop. He is asking for $100,000.

- Savings account: $15,000

- Motorcycle: $5,000

- Rent: $1,200 a month

- Truck payment: $500 a month

- Insurance: $200 a month

- Student loan: $150 a month

Ricky makes $60,000 a year, but he will need to quit his job in order to start the business.

Do you give Ricky the loan?

If no, why?

If yes, at what interest rate and why?

Maya’s Balance Sheet

Maya wants to expand her hair salon, adding a spa. She applies for a loan of $75,000.

- Cash on hand: $10,000

- Savings account: $7,000

- Personal home: $100,000

- Monthly income from salon: $3,500

- Mortgage for shop: $1,000 a month

- Insurance: $100 a month

Do you give Maya the loan?

If no, why?

If yes, at what interest rate and why?

Russell’s Balance Sheet

Russell wants to buy a boat for $35,000. He has taken out a loan from your bank previously to purchase what is now his rental property. He paid it back with no problems.

- Cash on hand: $2,500

- Savings account: $3,500

- Earnings from rental income: $700 a month

- Monthly income from surveying job: $4,500

- Mortgage for personal home: $2,000 a month

- Car payment: $600 a month

- Insurance: $300 a month

Do you give Russell the loan?

If no, why?

If yes, at what interest rate and why?