Commerce in Oklahoma

Oklahoma Goes Global

During the 1970s and 1980s, Oklahoma’s economy showed how thoroughly intertwined it was with the global economy. The volatility of Oklahoma’s economy demonstrated that finding a balance between supply and demand was even more critical when events throughout the world could directly impact the markets for Oklahoma goods and services. Oklahoma’s economy also reflected how intertwined government policies are with economies. What is produced, who benefits, and who makes economic decisions are important questions that governments—federal, state, local, and tribal—continuously try to answer.

Unlike the rest of the nation, which grappled with difficult economic trends such as stagflation, Oklahoma’s economy thrived in the 1970s. A major element of Oklahoma’s agricultural sector is cattle ranching. In the 1970s, meat prices increased because of a shortage. Ranchers chose to reduce the number of cattle they sold at market so they could produce more cattle in the future. This reduction caused the cost of meat to increase further. Ranchers saw once-in-a-generation profits.

Ranching prospered in the 1970s, and so did the state’s many wheat farmers. Grain harvest failures in the Soviet Union resulted in a crisis: either the USSR found grain for their population, or they faced famine. In 1973, the United States and the Soviet Union agreed to a deal. The Soviet Union would purchase ten million tons of grain from American farmers, and the United States government would help pay for it. US government officials did not recognize the size of global grain failures that year, so the movement of American grain to the Soviet Union caused global wheat prices to skyrocket. Oklahoma farmers experienced unprecedented profits.

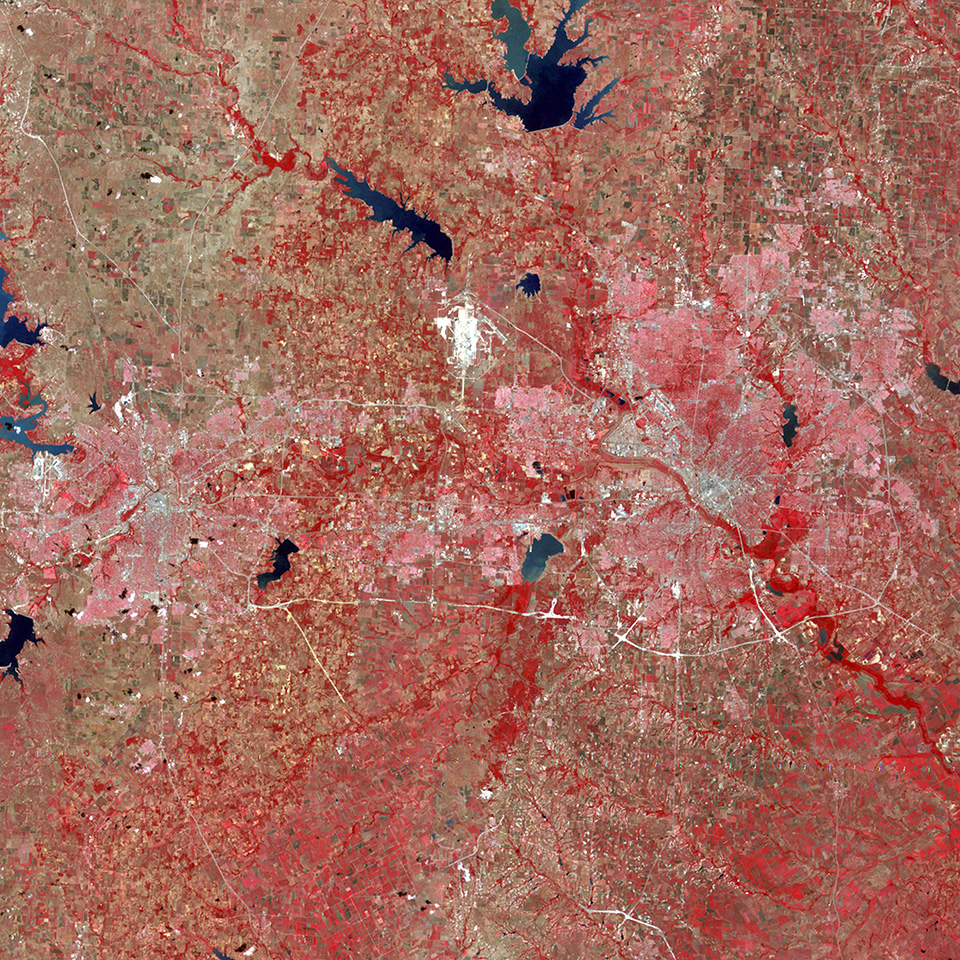

The first Landsat photo from 1972. If Landsat had launched six months earlier than it did, it would have allowed government officials to manage the wheat harvest so that the spikes and shortages were lessened (image courtesy USGS).

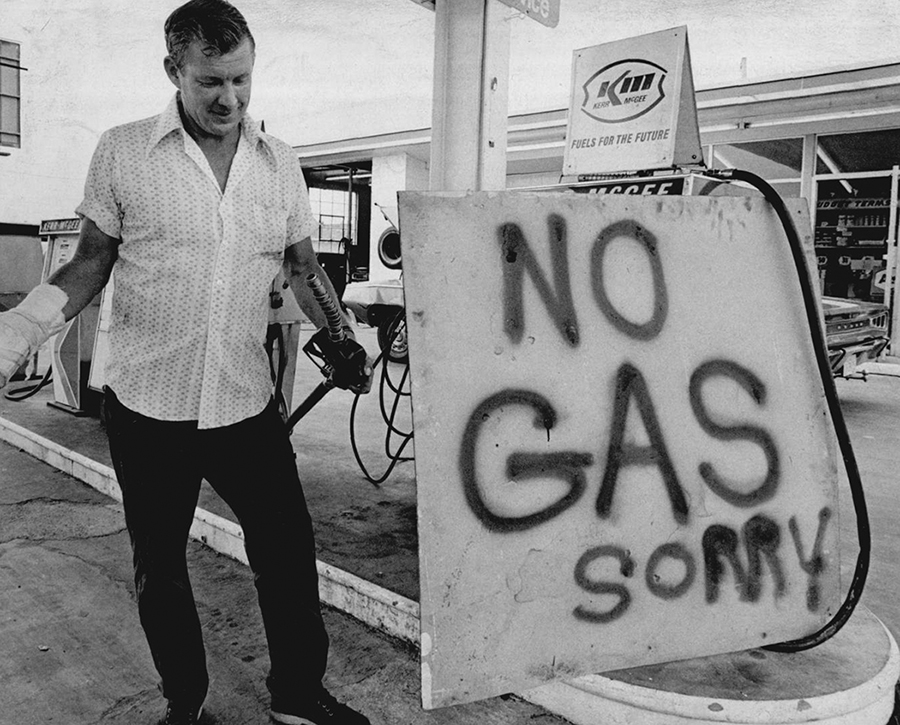

Oklahoma’s other major economic sector, oil and gas production, also experienced record profits in the 1970s because of global politics. In 1973, several Arab countries and Israel went to war. In retaliation for resupplying the Israelis, the oil cartel Organization of Petroleum Exporting Countries (OPEC) placed an embargo on the US, which means they refused to sell their petroleum to the US. This led to alarm throughout the country. People began hoarding fuel, which led to shortages. The shortages and perceived crisis resulted in huge jumps in oil prices. The removal of competition from OPEC meant petroleum producers in the US received a greater percentage of the overall amount paid for oil, in addition to the higher prices. Political disagreements in the Middle East resulted in high oil prices for the remaining decade.

Many gas stations throughout the country ran out of gas during the oil shocks in 1973 (2012.201.B1162.0232, OPUBCO Collection, OHS).

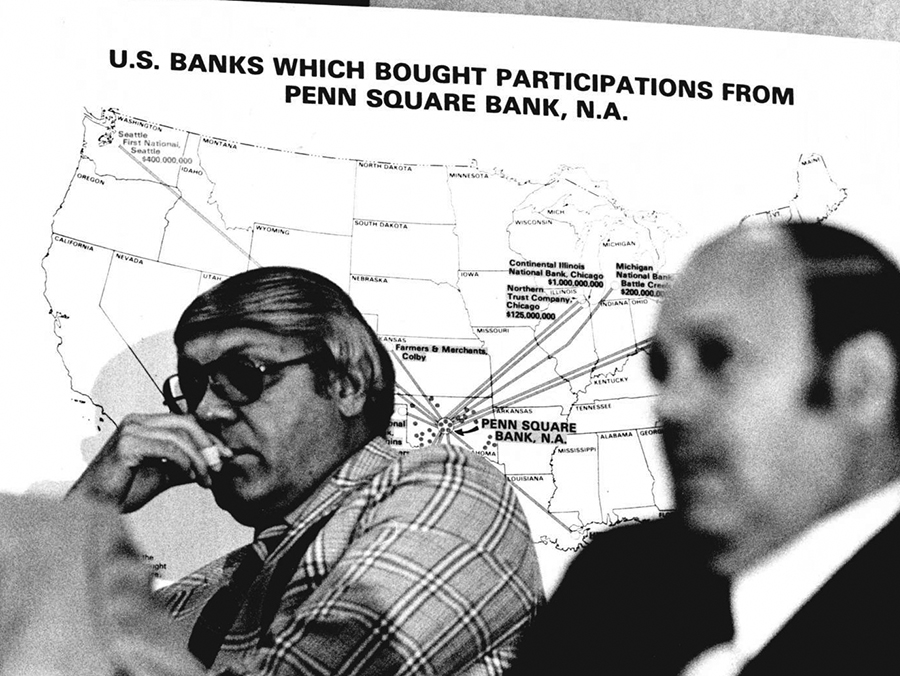

The 1980s tells the other side of the story. Just as global shortages boosted the income of Oklahoma producers, the return of competition in other parts of the world had negative outcomes for the state. During the strong economy of the 1970s, many producers sought to expand their businesses by taking out loans at high interest rates. Other producers may have taken on personal obligations such as car leases and loans or mortgages at high interest rates. When demand and profits fell in the early 1980s, some producers were unable to repay their debts. This is called a default. When enough debtors default, the bank may be unable to handle their daily business of withdrawals. If that happens, the bank fails. This happened in 1982 at Penn Square Bank in Oklahoma City. Bank operators had heavily invested in the oil industry and shared the loans they made with other banks. Oil prices dropped in 1981, and Penn Square Bank’s investments soured. Because Penn Square Bank shared debt with other banks across the country, banks began failing elsewhere.

An interconnected economy has its own challenges, as the Penn Square Bank failure demonstrated, photograph by Roger Klock, 1982 (2012.201.B0966.0089, OPUBCO Collection, OHS).