Government

Statutes

What is a Statute?

A statute is a law passed by a legislature. These laws usually enact or prohibit something. Statutes use an interesting character called the section sign. The section sign looks like this: §, and it reads as the word “section.” It serves to reference a particular section of a document.

Oklahoma Statutes

Oklahoma has many statutes that set rules for many things. One statute sets the standard weight and measurements for the state (Title 83), while others describe how the state agriculture system will function (Title 2).

Oklahoma Historical Society

The Oklahoma Historical Society (OHS) was created by a statute. It was created as part of the Oklahoma Historical Societies and Associations (Title 53) under chapter 1A - Oklahoma Historical Preservation Act. The statute establishes that OHS’s job is to hold present and future collections of the state for research and historical learning. Chapter 1A also creates other specific rules about how the society will conduct its business, such as dealing with money, interacting with tribal nations, and what to do and what to do with seasonal employees. Basically, Chapter 1A lays out the boundaries for OHS so it can do an effective job and represent the state well.

OHS employees in 1910 (20058, Oklahoma Historical Society Photograph Collection, OHS).

Oklahoma Highway Patrol

This is another agency created by Oklahoma statute. Statute Title 47 Motor Vehicles created the Oklahoma Highway Patrol. Chapter two, section 105 outlines pay, uniform standards, and use of force.

It is important to understand why these statutes are so detailed. They need to be detailed because they are the laws that govern the agencies they create. If the laws were not detailed, the agencies could do something that might harm the state or waste money. For instance, if the Oklahoma Historical Society was not given guidelines for dealing with money, the state could lose time and money investigating problems. The statutes are all about streamlining processes between the government and the agencies they create and ensuring the responsible use of taxpayer money.

Lateka Alexander is the first Black woman state trooper in Oklahoma (image courtesy Black Chamber of Commerce).

Revenue

What is a tax?

All of the services governments offer cost money. In order to pay for these services, governments tax the people living in their jurisdiction. There are a number of different taxes. Governments can also charge money for a service, called a fee. They can also require a person or business to pay money for something they have done that violates the law. This is called a fine. All of the money collected through taxes is called revenue. Sometimes, one level of government will receive funds from a different level of government. For example, the American Rescue Plan of 2021 provided extra funds for state, county, and municipal governments in order to help deal with the COVID-19 pandemic. Once a government has an estimate of how much revenue they will receive through taxes, fees, and fines, they will invest a lot of thought and time creating a budget to plan how to spend that money. Spending money is called an expenditure. Money spent on a particular agency or project is called an appropriation.

Kinds of taxes

Different levels of government depend on a different mix of taxes, fees, and fines to function. Knowing how each level of government collects revenue and what services they provide is an important part of citizenship.

Income Tax

An income tax is a tax on the money a person makes working. Most of the time, there is a way for an employer to send the income tax to the Internal Revenue Service (IRS) or the state tax commission. Most people must file their tax forms every year, showing how much they made and how much has already been sent to the governments that charge income tax. Some taxpayers may still owe these governments money because not enough was sent from the paychecks. Other taxpayers may have overpaid. If they overpaid, they will receive a refund.

Both the federal government and the State of Oklahoma depend heavily on income taxes to fund their services.

The IRS processes tax payments for the federal government (image courtesy IRS.gov).

The Oklahoma Tax Commission handles payments to the State of Oklahoma (image courtesy Oklahoma.gov).

Payroll Tax

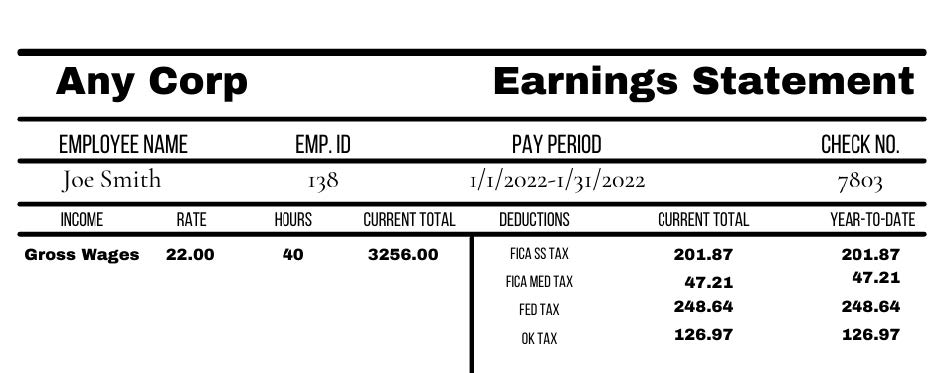

Payments taken out of a paycheck by an employer and sent to the IRS and state tax commission directly are called payroll taxes. In the United States, two important payroll taxes are common other than income tax.

The first shows up as FICA on a paystub; this is the tax a person pays to fund the Social Security Administration. This agency is responsible for payments to older Americans, individuals unable to work because of a disability, and those temporarily unemployed.

The second, which appears as MEDFICA, is a tax to pay for Medicare and Medicaid. Medicare is health insurance for older Americans, and Medicaid is health insurance that some Americans are eligible for based on their income.

Payroll taxes are federal taxes.

Learning how to read your paystub can help you understand where your money is going and protect you in case there is an error.

Property Tax

Property tax is a tax on property owned by a person or company. Property tax is determined by assessing the market value of the property, which means looking at similar properties nearby and determining how much they sold for. An odd word you might hear when people talk about property tax is a mill. A mill is $1 in tax for each $1,000 in taxable value on a property. County treasurers determine how many mills to charge on property in order to fully fund their government.

County governments are heavily dependent on property taxes. The majority of their revenue comes from property tax.

Sales Tax

A sales tax is a tax on items sold in a particular jurisdiction. If you have ever wondered why a candy bar with a price of $1 actually costs more when you purchase it, it is because you were charged sales tax. Sales tax is a percentage of the purchase price, which can vary from place to place as different places may charge different percentages.

The State of Oklahoma, every county except Oklahoma County, and municipal governments use sales tax to fund their services.

Corporate Taxes

Corporate taxes are taxes businesses must pay on the profits they make.

The federal government and the State of Oklahoma charge corporate taxes. They are not a significant source of revenue for either level of government.

Capital Gains

A capital gains tax is a tax on the sale of investments such as stocks, bonds, and real estate. The federal government and the State of Oklahoma charge a capital gains tax. These taxes are only a small portion of each government’s revenue.

There are other taxes, but these taxes make up the greatest percentage of government revenue.